You are here

‘Slight’ economic boost, further interest rate cuts predicted

By Elizabeth Turnbull - Aug 15,2019 - Last updated at Aug 15,2019

AMMAN — The Central Bank of Jordan’s recent move to lower the interest rate by 25 basis points is expected to bring about slight improvements to economic activity, loan growth and loan repayment capacity, credit rating agency Moody’s said in a recent report, predicting further rate cuts in the coming period.

"We believe further rate cuts are likely in the next 12-18 months, and we believe that lower policy rates will lead to lower lending rates, which will relieve some negative pressure on banks' asset quality," Moody's Investors Service said in its report, released on August 8.

While there may be negative implications on profitability as a result of lowering lending rates, Moody's predicted that positive effects on loan growth, the economy and the slight improvement to borrowers' loan repayment capacity will outweigh the modification’s fallouts.

The report's positive outlook on borrower's loan repayment capacity was echoed by economist and investment consultant Wajdi Makhamreh.

“Lowering interest rates will increase the people’s ability to repay loans by reducing loan repayment installments even though the lending margins for banks might be reduced,” Makhamreh told The Jordan Times on Thursday.

In addition, Makhamreh believes the Central Bank’s efforts will ultimately help advance certain economic sectors.

“The drop of interest rates in Jordan will minimise the financing costs for existing loans as well as future ones, which will support the economic activity for projects and sectors that have a competitive edge,” Makhamreh added.

The Central Bank’s move came in response to the US Federal Reserve rate cut on July 31.

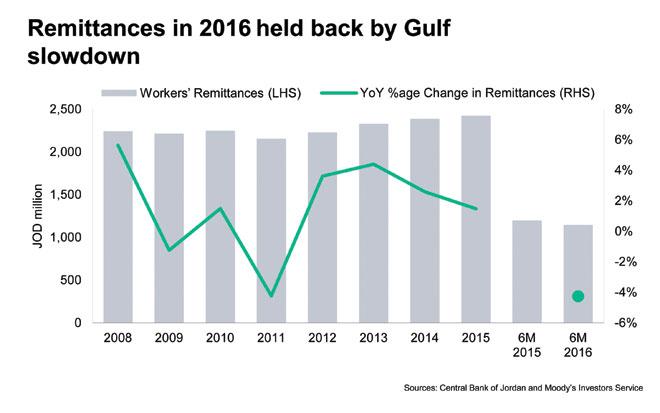

The leading credit agency also predicted that households would have an easier times repaying loans, as lower interest rates would reduce loan repayment installments, noting the increase of household debt-to-income ratio in Jordan from 41 per cent in 2008 to 67 per cent in 2017.

“Given the bad economic situation in Jordan, any reduction in the interest rate will benefit the economy big time in the medium and long term and will increase companies’ profitability given the low level of financing costs,” Makhamreh said.

Related Articles

WASHINGTON — Moody's said recently that it has upgraded Turkey's credit rating on improved governance and progress on inflation, while maint

AMMAN — Moody's Investors Service said on Wednesday that although credit risks remain high for banks in Jordan, their sound capital and liqu

NEW YORK — Global shares mostly retreated Monday as markets awaited a Federal Reserve interest rate decision while concerns over political b