You are here

Jordanian banks to maintain sound liquidity despite challenging conditions — Moody's

By JT - Jan 26,2017 - Last updated at Jan 26,2017

AMMAN — Moody's Investors Service said on Wednesday that although credit risks remain high for banks in Jordan, their sound capital and liquidity provide a buffer to downside risks.

Profitability will remain stable in 2017, despite higher provisioning expenses, owing to improving margins, it added in its report, entitled "Banks — Jordan: Solid Capital Buffers, Regulatory Reforms and Higher Interest Margins Provide Support Amid Regional Turbulence”.

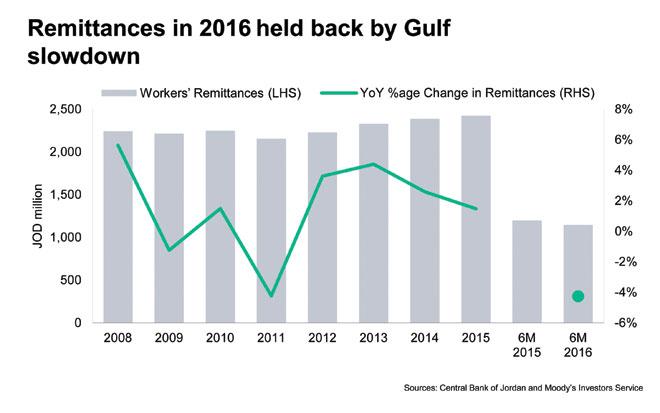

The closure of the Iraqi and Syrian borders with Jordan coupled with weak financial conditions in Gulf countries weigh on trade, tourism and investor sentiment in the country and on growth, as a result. Accordingly, as published previously, Moody's said it expects only a moderate uptick in real gross domestic product (GDP) growth in Jordan to

3.2 per cent for 2017.

Furthermore, rising interest rates, driven by recent and future Fed rate increases and the Jordanian dinar's peg to the US dollar, will moderate the demand for credit, especially from households, according to Moody’s report.

Under these challenging operating conditions, Moody's expected domestic credit growth of 6 -7 per cent in 2017, down from 8 per cent in 2016.

Moreover, it added that asset risks would remain high for Jordanian banks due to credit concentration, including high exposure to the government, and rising household indebtedness.

The Jordanian banking system's large size relative to the GDP and substantial cross-border operations would increase systemic and contagion risk. Banks' consolidated total assets stood at 278 per cent of the GDP as of the end of 2015.

However, "we expect a broadly stable return on assets for Jordanian banks of around 1.4-1.5 per cent for 2017," Alexios Philippides, assistant vice president at Moody's said.

"Higher provisions against new non-performing loans will be largely offset by improving net interest margins as interest rates rise, as well as further operating efficiency gains."

Moreover, new regulation in Jordan will support the resilience of the banking sector. Basel III capital requirements were implemented last year and a planned 2017 amendment of the Deposit Insurance Corporation law will create a more robust bank recovery and resolution framework, bringing it in line with the Financial Stability Board's “Key Attributes”, according to Moody’s.

Sound capital and liquidity would provide a buffer to downside risks, it reiterated.

Related Articles

PARIS — The coronavirus pandemic will push Britain and the euro area into recession this year, with their economies expected to shrink by as

AMMAN – Jordanian banks benefit from gradually improving operating conditions but will continue to face challenges in 2016, says Moody's Inv

AMMAN — Moody's Investors Service affirmed Jordan's long-term issuer and senior unsecured ratings at B1 and maintained the stable outlook fo