You are here

US debt deal faces tough sell in Congress to avoid default

By AFP - May 28,2023 - Last updated at May 28,2023

WASHINGTON — A day after securing a tentative deal to prevent a cataclysmic US debt default, Republican and Democrat leaders began the hard task on Sunday of winning over sceptics in both their parties in order to shepherd the legislation through Congress before the government runs out of money.

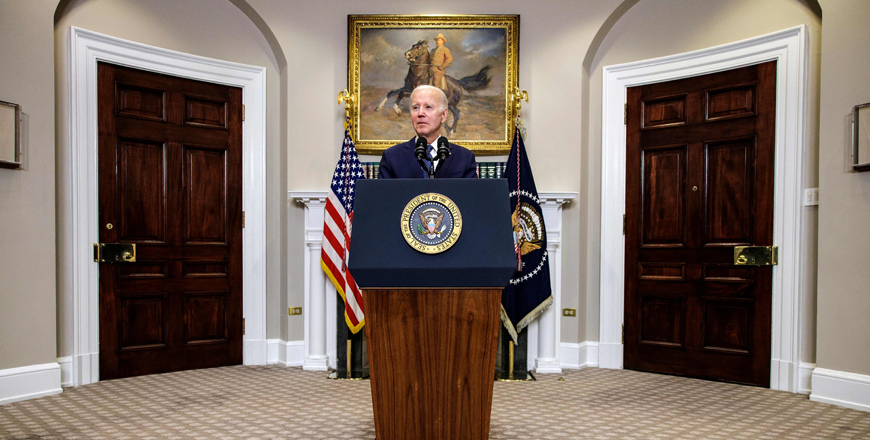

The agreement announced Saturday by President Joe Biden and Republican leader Kevin McCarthy after weeks of crisis talks offers a path back from the default precipice, but it is far from certain that the compromises it contains can garner the support it requires from both sides of the aisle.

And all the while the clock is still ticking down to the June 5 "X-date" when the Treasury estimates the government will start to run out of cash to pay its bills and debts.

A default would likely have catastrophic consequences, triggering a US recession and risking a global economic meltdown.

The basic framework of the deal suspends the federal debt ceiling, which is currently $31.4 trillion, for two years - enough to get past the next presidential election in 2024 and allow the government to keep borrowing money and remain solvent.

In return, the Republicans secured some limits on federal spending over the same period.

Unhappy right, and left

Congressional opposition to the bill comes from an unlikely union of hard-right Republicans who wanted deeper spending cuts and progressive Democrats who wanted no reductions at all.

McCarthy has called for a vote Wednesday in the House where his party’s wafer thin majority means passing the bill will require significant Democrat backing to balance out Republican dissent.

The speaker was on Fox News Sunday in the morning, arguing that the spending limits were a significant victory and insisting that 95 per cent of House Republicans were “very excited”.

“Maybe it doesn’t do everything for everyone, but this is a step in the right direction no one thought we would be at today,” McCarthy said.

But the strident tone of the Republican opposition was set by Representative Dan Bishop, a member of the ultra-conservative House Freedom Caucus, who tweeted a vomit emoji and slammed McCarthy for securing “almost zippo”.

Nicholas Creel, a political analyst and business law professor at Georgia College and State University said the deal was “ultimately likely” to pass through Congress, but he warned that “Freedom Caucus Republicans have the potential to play spoiler if they decide to go scorched Earth on McCarthy”.

McCarthy and Biden were scheduled to speak Sunday to finalise the deal, after which a text of the bill will be released and party whips will go into overdrive to ensure it has enough votes.

The tentative agreement represents a climb down of sorts by both sides.

Biden had initially refused to negotiate over spending issues as a condition for raising the debt ceiling, accusing the Republicans of taking the economy hostage.

And the big cuts that Republicans wanted are not there, although non-defense spending will remain effectively flat next year, and only rise nominally in 2025.

Biden said “the agreement represents a compromise, which means not everyone gets what they want. That’s the responsibility of governing.”

“Overall, the deal is probably best viewed as a win for Biden and Democrats given that it contains fairly modest spending cuts and would prevent another debt ceiling showdown or a government shutdown during the remainder of Biden’s presidency,” Creel said.

“Nobody has enough power to get too much of what they want right now, so a compromise like this that makes everyone a little unhappy is probably the best anyone could have hoped for,” he added.

Speed of the essence

The countdown to the June 5 “X-date” means the legislation will still have to clear Congress much more quickly than the normal timetable for even the most uncontroversial bills.

McCarthy is hoping to bring the narrow House majority of 222 Republicans with him, but opposition will come from 35 far-right lawmakers who told him to “hold the line” for more sweeping spending cuts.

That means a large number of Democrats will have to be persuaded to vote with a reduced number of Republicans, something that rarely happens on big bills.

If a default still occurs, the government would not miss loan repayments until mid-June but in the meantime it would likely have to halt $25 billion in social security checks and federal salaries.

The battle has been monitored closely by the major ratings agencies, with Morningstar and Fitch both warning that they could opt for a downgrade, even if the crisis is averted.

Related Articles

WASHINGTON — Republican and Democratic leaders scrambled on Monday to secure congressional support for a bill aimed at avoiding a catastroph

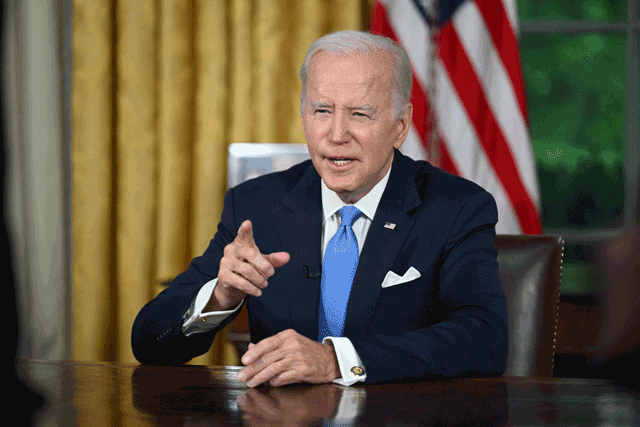

WASHINGTON — US President Joe Biden told Americans on Friday in a rare Oval Office address that the debt ceiling bill passed by Congress aft

WASHINGTON — President Joe Biden vowed on Friday to get his sweeping domestic agenda over the line as he visited the US Congress to energise