You are here

97% of ASE listed companies complied to submit their 2023 Q3 reports within specified period

By JT - Nov 03,2023 - Last updated at Nov 03,2023

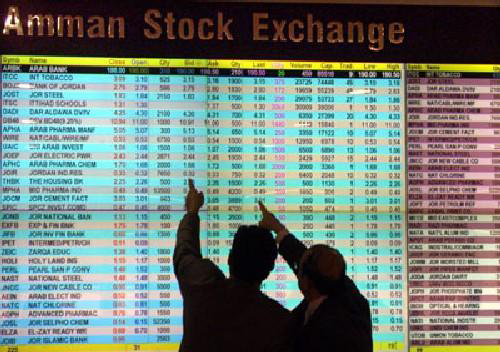

All listed companies on the ASE should provide their reviewed interim financial statements within the specified period, according to the directives for listing securities on the ASE (Petra Photo)

AMMAN — Mazen Wathaifi, chief executive officer of Amman Stock Exchange (ASE), said that 97 per cent out of 168 listed companies have provided the ASE with their reviewed quarterly financial statements for the period ended September 30 during the specified period, through the e- disclosure System XBRL.

This high percentage reflects the compliance of listed companies with the laws and regulations, and the compliance of such companies with the principles of transparency and disclosure, according to the website of ASE.

Wathaifi added that all listed companies on the ASE should provide their reviewed interim financial statements within the specified period, according to the directives for listing securities on the ASE. He also confirmed that the ASE posts these financial statements on the ASE website www.exchange.jo under circulars and disclosures/quarterly reports window.

Wathaifi stated that profits after tax attributable to the company's shareholders for the three quarters of 2023 for the public shareholding companies listed on the ASE that provided their financial statements decreased to reach JD1641.2 million, compared with JD1991.8 million for the same period of 2022, a decrease of 17.6 per cent.

Profits before tax for these companies also decreased, reaching JD2311.4 million for the three quarters of 2023, compared with JD2705.5 million for the same period of 2022, a decrease of 14.6 per cent.

In terms of sectors, profits after tax attributable to the company's shareholders for the financial sector of companies that provided the ASE with their financial statement increased by 32.9 per cent, the services sector decreased by 24.2 per cent and the industrial sector decreased by 47.3 per cent, the website stated.

He added that the decline in these percentages is relative since the comparison is made with many listed companies achieving record and unprecedented profits in 2022. The profits achieved for this period in 2023 are high compared with previous years, considering the financial and monetary stability and the improvement in many national economic performance indicators.

He also pointed out that the number of profitable companies for the first three quarters of this year has increased to 112 companies compared with 106 companies in 2022. The number of companies that incurred losses has decreased to 51 companies compared with 57 companies in 2022.

Additionally, a number of subsectors have seen increases, with the engineering and construction industries, the hotel and tourism, the real estate, the diversified financial services, the electrical industries, the insurance, the bank sector, and the chemical industries sector recording increases of 410.7 per cent, 392 per cent, 179.3 per cent, 159 per cent, 83.4 per cent, 48.5 per cent, 30.8 per cent and 3.7 per cent respectively.

Related Articles

AMMAN — Ninety-six per cent of 167 listed companies have provided the Amman Stock Exchange (ASE) with their reviewed quarterly financial sta

AMMAN — Chief Executive Officer of Amman Stock Exchange (ASE) Mazen Wathaifi said that 95.2 per cent out of 169 listed companies have provid

AMMAN — Chief Executive Officer (CEO) of the Amman Stock Exchange (ASE) Mazen Wathaifi stated that 162 out of 174 listed companies provided