BAGHDAD — Iraq's premier summoned the central bank governor on Tuesday amid worries sparked by a currency drop against the dollar, with lawmakers calling for an extraordinary session of parliament.

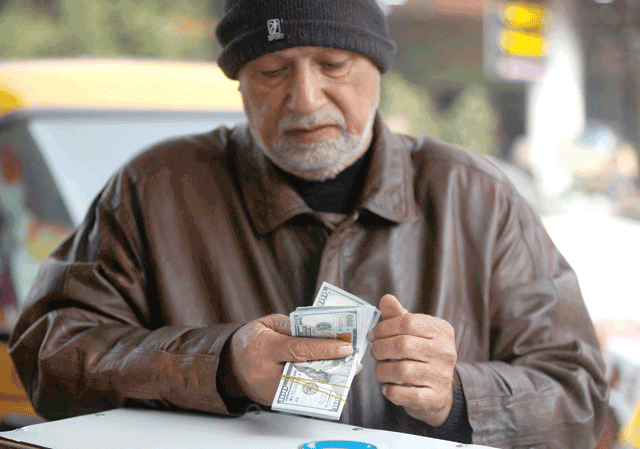

One US dollar traded at 1,580 Iraqi dinars on the street on Tuesday, against the central bank rate of 1,470 dinars, state news agency INA reported.

The drop, which began about two weeks ago, has sparked alarm in the media in the oil-rich country, and on Tuesday Prime Minister Mohammed Al Sudani met the central bank governor to discuss the issue.

The cental bank has blamed the slump on "temporary pressures" sparked by the "adoption of new mechanisms to protect the banking sector, customers, and the financial system".

Iraq's Association of Private Banks said the rate had risen as a result of changes to the "mechanism" of foreign currency sales due to international requirements.

The government has sought to ease tensions, including by ensuring a flow of dollars at the official rate.

Prime ministerial adviser Muzhar Saleh told INA on Sunday said there were "no fears" about Iraq's ability to maintain the exchange rate, noting foreign reserves were at "a high in Iraq's financial history", likely exceeding $100 billion.

Economist Safwan Qusai said confidence in the dinar had been "shaken" by corruption scandals, with problems sparked by US Treasury restrictions imposed on "financial transfers to certain countries".

Graft, mismanagement and nepotism are rife in Iraq where they have caused widespread public anger. Iraq ranks near the bottom of Transparency International's corruption perceptions index, at 157 out of 180 countries.