You are here

JSF report sheds light on Jordan’s ‘robust’ banking sector

By JT - Dec 04,2022 - Last updated at Dec 04,2022

AMMAN — On the United Nations' International Day of Banks, annually celebrated on December 4, the Jordan Strategy Forum (JSF) issued a policy paper titled “Banks in Jordan: December 4, the International Day of Banks".

The paper aimed to review the performance of Jordanian banks and rank the Kingdom's banking sector on the International Monetary Fund's (IMF) Financial Development Index, according to a JSF statement.

The paper noted that Jordan's banking sector is the second most stable (out of 165) after Luxembourg, based on data from the IMF, which measures the extent to which the banking system is likely to be hampered by the so-called "Z-Score".

The forum said that Z-Score is calculated based on comparison between countries on the basis of capital adequacy and return ratio, and the level of volatility of those returns.

The paper stated that Jordan's “robust” banking sector is a result of the sector's level of profitability (return on assets), capital adequacy ratio (total equity capital compared to total assets) and low volatility (standard deviation of return on assets).

In this regard, the forum noted that the volume of bank assets operating in Jordan and the volume of total deposits and credit facilities increased at a level higher than nominal GDP over time.

In addition, banks in Jordan have been the government's main lender in recent years, with 52 per cent of all treasury and government bonds held by banks operating in Jordan, the paper noted.

With regard to credit facilities granted to the private sector, the report showed that the construction sector accounted for the highest proportion of total credit facilities granted between 2018 and 2021, standing at 25.7 per cent.

The JSF referred to the importance of banks' role in the Amman Stock Exchange (ASE), noting that the 14 Jordanian banks listed on the ASE constitute an integral part of the Jordanian capital market, as their total pre-tax profits constitute 59.9 per cent of the total profits of all companies listed on the ASE between 2019 and 2021.

The average taxes paid by these 14 banks during the 2019-2021 period accounted for 61.7 per cent of taxes paid by all listed companies. In addition, the market value of these banks constitutes 50.5 per cent of the total market value of all ASE-listed companies.

Meanwhile, the forum noted that Jordan's performance on the Financial Development Index has declined over the last four decades, with Jordan's global ranking falling from 6th in 1980 to 68th in 2020.

The forum commented that Jordan's declining performance and ranking was due to financial markets rather than financial institutions, as financial markets fell significantly from 0.56 in 1980 to 0.24 in 2020, while financial institutions rose from 0.35 in 1980 to 0.45 in 2020.

The JSF stressed that the financial sector must be developed through policy initiatives including increasing public and private access to finance and strengthening the insurance sector and its role in Jordan's economy.

The forum also recommended increasing equities and bonds and accelerating financial digitalisation to boost the financial sector and the capital market.

Related Articles

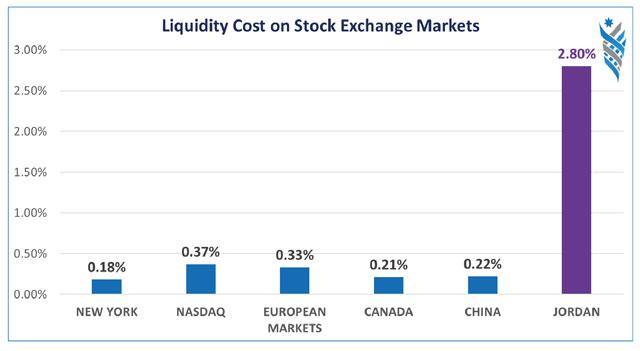

AMMAN — A paper recently published by the Jordan Strategy Forum (JSF) recommends licensing interested companies to provide liquidity as the

AMMAN — The Amman Stock Exchange (ASE) has become a public shareholding company fully owned by the government, according to an ASE statement

AMMAN — Jordan’s public debt and budget deficit levels are negatively affecting banks´ credit available to the private sector, according to