You are here

‘Public debt, budget deficit affecting banks’ credit to private sector’

By Ana V. Ibáñez Prieto - Feb 25,2018 - Last updated at Feb 25,2018

Jordan’s public debt and budget deficit levels are negatively affecting banks´ credit available to the private sector, according to a policy paper issued on Saturday by the The Jordan Strategy Forum (JT file photo)

AMMAN — Jordan’s public debt and budget deficit levels are negatively affecting banks´ credit available to the private sector, according to a policy paper issued on Saturday by the The Jordan Strategy Forum (JSF).

Citing the report’s findings,economist Wajdi Makhamreh explained that “the public debt and increased budget deficit are reducing the loanable funds available at the banks, causing the crowding out of the private sector from the credit market”.

The study, titled “Public Borrowing in Jordan: Does it Crowd Out Bank Credit to the Private Sector?”, examined the impact of public debt on bank credit at the macro and micro levels, analysing the data sourced from the financial statements of all 13 licensed commercial banks across the Kingdom.

Overall, the paper identified an increase in Jordan’s public debt from the 67 per cent of the GDP in 2010 to an expected 93.5 per cent by the end of 2018, showing a faster growth rate than that of the GDP itself.

The study attributed the “sizeable increase in public debt” to the annual budget deficit, stressing that the total public debt is predicted to stand at JD28.20 billion by the end of 2018.

“During the period between 2009 and 2016, the mean ratio of banks’ holdings of government securities to their total assets was equal to 22 per cent,” the policy paper indicated, noting that “Jordanian banks’ capital to risk weighted assets is relatively high when compared to Switzerland [16.1 per cent], Kuwait [17.7 per cent], Saudi Arabia [16.6per cent], or Morocco [13.9 per cent].”

In this regard, the study explained that “over time, local public debt increases in importance in explaining the variability in bank credit to the private sector,” adding that “banks that invest a larger percentage of their assets in government securities tend to maintain a lower ratio of credit to the corporate sector to total credit”.

“The low ratios [of credit to the corporate sector to total credit] maintained by Jordanian banks increase their appetite to lend to less risky sectors such as retail or the real estate sector rather than the corporate sector,” Makhamreh highlighted, noting that “investing in government securities encourages banks to reduce the riskier parts of their lending”.

Considering the findings, the forum recommended that the government “re-examine its public finances and come up with some remedial measures,” stressing that such measures “must consider both the public spending aspect and the public revenues aspect”.

The study also called on the government and the banks to look into developing a secondary market for government securities, explaining that “this would reduce the banks’ holdings of these securities, and such a market would be an instrumental source of public finance from the private sector in general rather than mostly banks”.

In addition, the paper encouraged banks to increase their “risk appetite” in order to “seek profitable opportunities and hence lend more”, as well s activating private economic agents such as retail, the corporate sector and small and medium enterprises (SMEs).

“We can’t change the structure of the banks and their shareholders, but the solution to this issue requires analysing the capital market in search for other methods to secure funds,” economist Khalid Zubeidi told The Jordan Times, noting the “current high interest and the need to establish long term loans”.

“This way, it would be possible to reduce the cost of loans and increase the funding for sectors such as the agricultural, which is currently facing difficulties due to the high interest rate,” the economist added.

“This study provided a great insight on the economic situation, but the government is not able to find real solutions,” Zubeidi concluded, stressing that “the solution should start from the banks”.

Related Articles

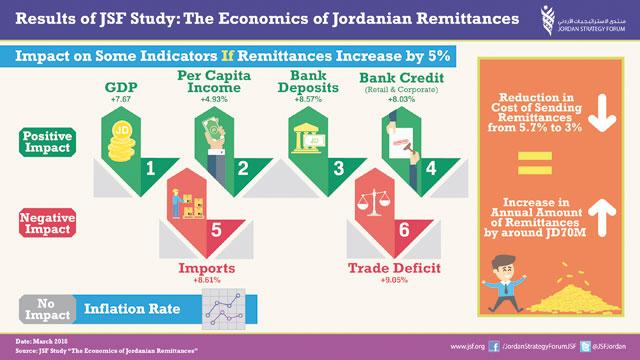

AMMAN — The Jordan Strategy Forum (JSF) on Wednesday issued a report calling for decision makers to prioritise policy dealing with Jordanian

AMMAN — Individuals' debt-to-income ratio (DIT) reached around 63 per cent by the end of 2014, according to the Central Bank of Jordan.In it

AMMAN — Licensed banks in Jordan have increased domestic credit to the private sector from 14.8 per cent of GDP in 1965 to more than 7